A Crypto GRID Trading Bot works by using algorithms to analyze market data and make trades based on predetermined rules and conditions. The bot will analyze market trends, identify profitable opportunities, and execute trades automatically. This allows traders to take advantage of market fluctuations without having to constantly monitor the market.

When grid trade, every buy order will place a sell order. If you have 4 buy orders, a total of 4 sell orders will be placed. Therefore the spot grid trading bot will place the grid of limit orders scattered at the same distance from each other. As soon as the target is reached the bot will close the position and will automatically open another limit order. The Grid robot has a continuous closed loop of work. In other words, once the robot closes all sell orders, it will place a new buy order and start a new cycle.

When trading with a Crypto Grid Trading Bot, you may employ a variety of techniques. Among the most prevalent strategies are

• Trend Following: This approach entails purchasing into an upward trend or selling into a negative trend and following the general market trend. The idea is to profit from the market's general price change.

• Mean Reversion: This strategy involves buying into a cryptocurrency that has been oversold, or selling a cryptocurrency that has been overbought. The goal is to profit from the return of the price to its average level.

• Scalping: This strategy involves making small, quick trades to profit from small price movements. Scalping is often used in high-volatility markets and requires a fast and accurate trading bot.

• Market Making: This strategy involves continuously buying and selling a cryptocurrency to profit from the spread between the buy and sell price. Market makers use algorithms to continuously monitor the market and make trades to take advantage of the spread.

• Arbitrage: This strategy involves taking advantage of price differences between different exchanges. An arbitrage bot will continuously monitor the prices on multiple exchanges and make trades to profit from any price differences.

These are just a few of the strategies that can be used with a Crypto Grid Trading Bot. It is important to carefully consider your trading goals and risk tolerance before choosing a strategy and to continually monitor and adjust your strategy as market conditions change.

First of all, you will need to identify the trading range of the asset, selecting the lower and upper limits of that price range. Then you need to determine the entry point, the trading volume of the first order and additional orders, the take profit percentage, and the price step of additional orders.

Grid trading crypto bots can use different indicators to determine the entry point and the channel range like Bollinger, RSI, and/or MACD indicators. If you do not use any signals, the robot will continuously place orders and start a new trading cycle immediately after the last sell order is executed based on the previous settings. If you do not have enough time or experience to trade with the grid bot then your best option will be to use the crypto copy trading platform to assist you with trading.

When developing a trading script, you must also set the stop loss level to construct the fully automated grid approach. When the unrealized loss exceeds the value you specify in the stop loss column, the stop loss is activated, and the robot sells the unsold currency at market value. The robot will cease selling if the stop loss is reached. Some of the exchanges will provide a free grid trading bot. Exchanges such as Kucoin and Binance futures grid bot

Once you have chosen a Crypto Grid Trading Bot, the next step is to set it up. This typically involves:

• Creating an account with the bot

• Connecting the bot to your exchange account

• Setting up your trading rules and conditions

• Activating the bot to start trading

A spot grid bot is one method by which individuals trade cryptocurrency automatically. It works by placing a grid of buy and sell orders at specific prices in order to profit when the market rises and falls. This bot is utilised in the spot market, where items are purchased and sold in real time. Traders can profit from price changes in the market by employing this grid of orders.

RID strategy can also be applied to the futures markets of automated trading that is mostly utilised in the futures market, particularly for cryptocurrency trading, is the futures grid bot. The way this bot operates is by creating a grid of buy and sell orders in the futures market at predetermined prices. Futures trading comprises contracts to purchase or sell goods at a certain price in the future, as opposed to spot trading, which involves buying and selling items instantly. Making money from fluctuations in futures prices is the aim of the futures grid bot. It accomplishes this by utilising the grid approach to profit from market fluctuations and the direction in which prices are trending.

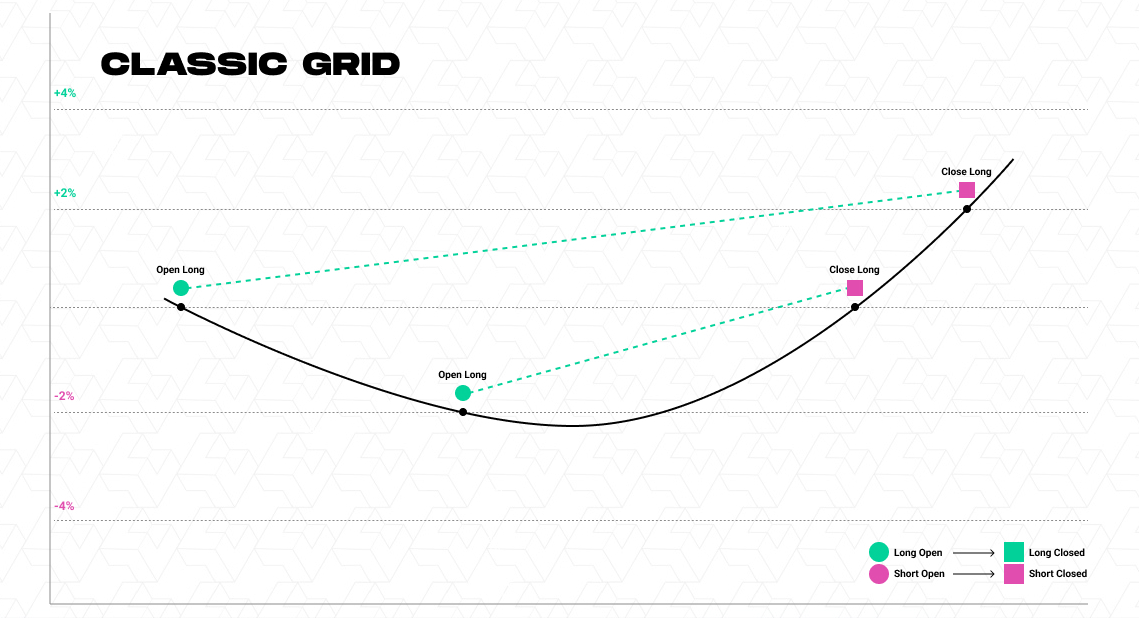

A Classic Grid bot (aka one-way Grid bot) is an automated trading strategy used in various financial markets, including cryptocurrency trading. This kind of bot works by putting a grid of buy or sell orders on just one side of the market. Whereas a bidirectional or two-way grid bot executes buy and sell orders simultaneously, a one-way grid bot concentrates on making money in a single market direction.

A one-way grid bot may, for instance, issue a string of purchase orders at predefined price points in a bull market in an effort to profit from price increases. On the other hand, it may execute sell orders in a bad market to profit from declining price patterns. The order grid facilitates the bot's ability to capitalise on market swings and produce profits according to the selected directed approach.

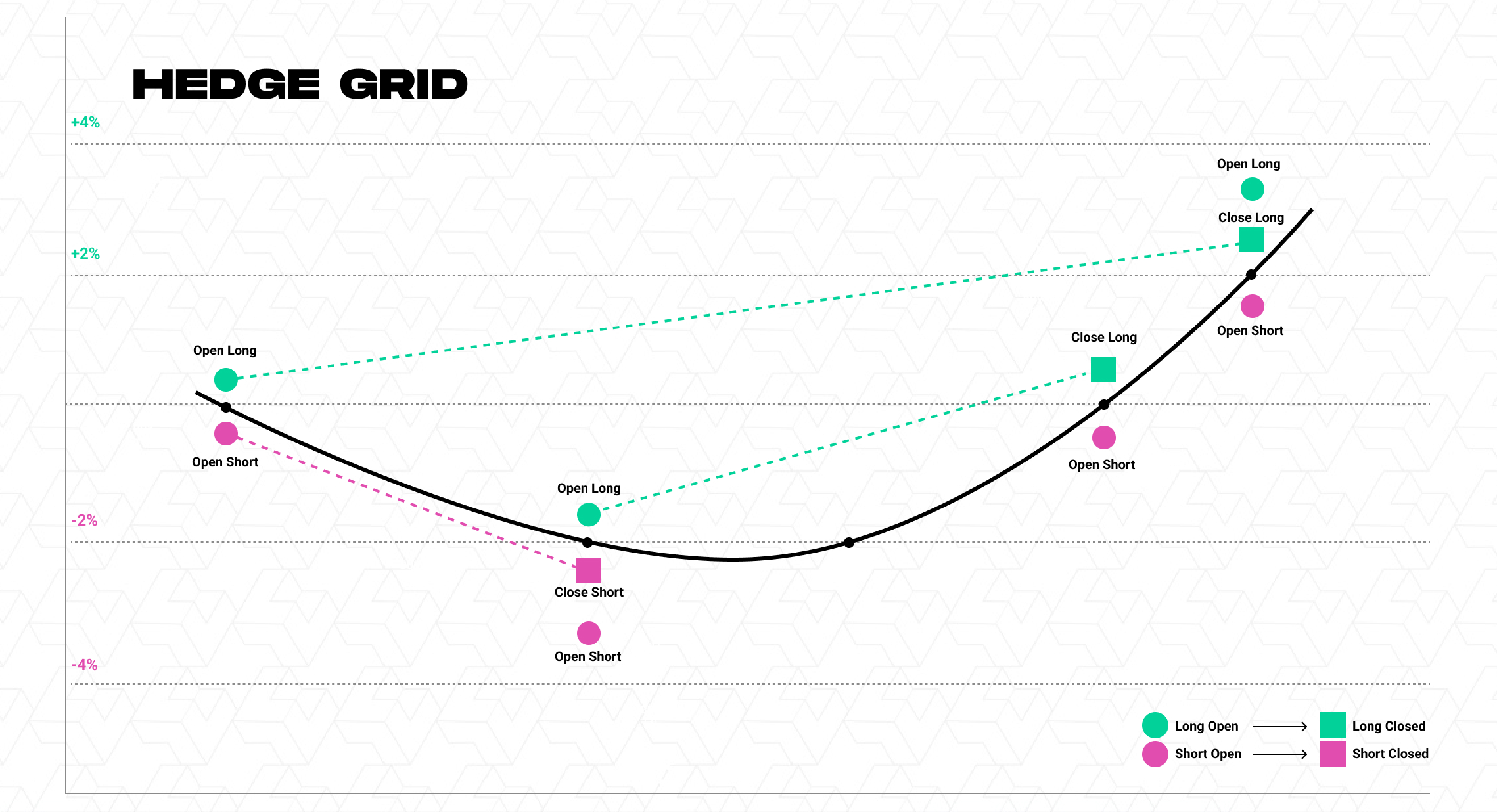

This type of bot include hedge GRID strategy and operates by placing a grid of both buy and sell orders at predefined price levels above and below the current market price.

The key characteristics of a two-way grid bot include:

Bi-directional Grid: Unlike a classic grid bot that focuses on either buying or selling, a two-way grid bot covers both sides of the market by placing buy orders and sell orders at the same level.

Profit from Price Oscillations: The goal of the two-way grid bot is to capitalize on price fluctuations within the specified grid intervals. As the market moves, the bot automatically executes trades at different price levels, aiming to profit from the oscillations.

Dynamic Adjustment: Depending on market conditions, the two-way grid bot may dynamically adjust the grid by adding or removing orders. This adaptability allows the bot to respond to changing price trends.

Risk Management: Traders often implement risk management features in two-way grid bots to control exposure and limit potential losses. This may include setting stop-loss orders or incorporating other risk mitigation strategies.

Suitable for Range-Bound Markets: Two-way grid bots are particularly suitable for markets that exhibit range-bound behavior, where prices fluctuate within a certain range over time.

Continuous Operation: The bot operates continuously, monitoring market movements and executing trades according to the predefined grid strategy. This continuous operation makes it well-suited for capturing profits in markets with frequent price changes.

Traders use two-way grid bots to automate trading activities, reduce manual intervention, and implement systematic strategies to navigate dynamic market conditions. As with any automated trading strategy, it's crucial for traders to thoroughly backtest and monitor the performance of the two-way grid bot to ensure its effectiveness in different market scenarios.

An interval grid bot is an automated trading strategy commonly used in cryptocurrency markets.This kind of bot works by setting up a grid of buy and sell orders at predetermined intervals of price. The predefined price levels where the bot will execute trades are referred to as the intervals.

The primary purpose of an interval grid bot is to profit from price fluctuations that occur within the specified intervals. The bot takes advantage of price fluctuations by buying and selling assets at regular intervals as the market changes.

Traders may use this technique to adopt a systematic approach to trading and profit from market volatility within predefined boundaries. Interval grid bots perform effectively in range-bound marketplaces, where prices vary over time within a specified range.

An infinity grid bot is an automated trading strategy often used in cryptocurrency markets. This type of bot operates by placing a grid of buy and sell orders at various price levels, both above and below the current market price. Unlike a finite grid, which has a limited number of orders, an infinite grid bot continually adjusts and adds new orders as the market moves.

The key characteristic of an infinite grid bot is its ability to adapt to changing market conditions without a predefined limit on the number of grid levels. As the market fluctuates, the bot dynamically adjusts the grid, adding new orders to capitalize on price movements.

The goal of the infinite grid bot is to generate profits from the continuous oscillations in the market, regardless of the market's overall direction. Traders often use this strategy in volatile markets where prices experience frequent and unpredictable fluctuations.

A grid bot backtest involves simulating the performance of a grid trading strategy using historical market data to assess how the strategy would have performed in the past.

It is noteworthy that although backtests offer significant insights, their foundation lies in historical data and previous performance. Future outcomes could differ as market conditions could change. Backtesting should be a part of a thorough strategy development process for traders, and they should proceed with caution when incorporating past performance into current trading decisions.